Interest Rate Monitoring

The interest-rate-monitoring DIM is an easy way to allow your users to find personal loan offers that they qualify for, and to monitor their latest rates over time. After getting set up to use Spinwheel’s drop-in modules, you will render interest-rate-monitoring to initiate the module.

Here are some helpful tips about Interest Rate Monitoring:

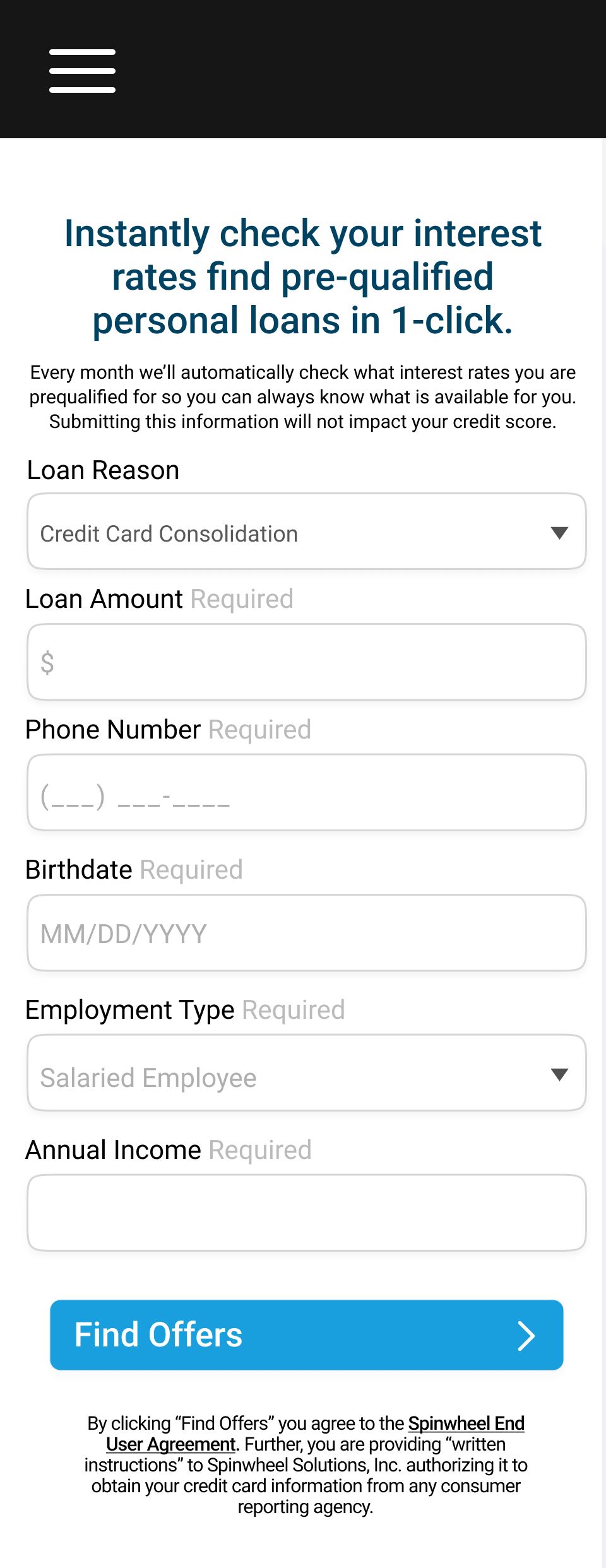

Users only need to input the following fields:

- Loan reason

- Loan amount

- Phone number

- Date of birth

- Employment type

- Annual income

- Once a user receives, selects and confirms an offer; the

APPLICATION_OFFERevent will be triggered. Within the metadata of this event (metadata.result.offerUrl) will be an offer url which you must redirect the user towards to complete the transaction on the lender’s site. - Applications are automatically resubmitted on behalf of the user every 31 days

- Any attempts to submit applications for the same user more frequently than 31 days will return a failure, because the servicers will recognize this as a duplicate lead

- Upon returning to the DIM, users will be able to see their latest offers

- If your users have already connected via

identity-connect, their phone number and date of birth will be pre-populated, and the date of birth field will be hidden in the UI - You can pass the

loanPurposeandloanAmountto pre-populate these fields. They will also be hidden from the UI - Users can choose to pause their monitoring at any point, and we will stop pulling new offers for them

Updated 5 months ago