Connect DIM - SMS

This is a guide taking you through the setup required for the embedded debt connect module known as 'identity-connect'

Before getting started

Haven't worked with our DIMs before? We suggest reading our complete Drop-in Module guide here before getting started. If text isn't your thing, we also have a video walkthrough that will get you up and running on the DIM Implementation page.

Important

After creating a user with an extUserId, you should not attempt to connect another user with that same extUserId. This is because it represents a real user and there is a one-to-one relationship between extUserIds and users in the Spinwheel system. Once connected, that user can be referenced by their userId throughout API calls or when invoking other DIMs.

Steps

We have designed these modules to make accessing debt as streamlined as possible. As such there are only a small number of steps that you have to follow in order to get up and running. The steps are as follows:

- Render the embedded debt connect module on your user facing app using the module name: identity-connect (unsure how to do this? Start here.)

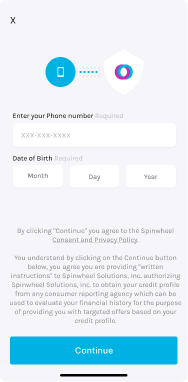

- The identity-connect DIM is the gateway for the user to 1. authenticate, and then 2. fetch their liability data in a single streamlined fashion

- Have your user fill out the brief form (we only require their phone number and date of birth)

- Listen to the callbacks to help define your user conversion funnel for the initial authentication that occurs (this step is a vital first step to connecting the user to their liabilities)

- Listen to the USER_LIABILITIES_CONNECTED webhook to know when the user's credit report has been successfully connected

Spinwheel will then validate the user's identity and pull in their liabilities which can be accessed from the /v1/users endpoint.

Sandbox User Data

User identities have been set up in the sandbox environment providing a variety of scenarios that you can use to test your integration against.

Default users need any valid US phone number plus a date of birth; for specific debt profiles, refer to the accompanying table.

| Date of birth | Description |

|---|---|

| 1990-01-01 | This user has debt totaling $5,000 distributed across an auto loan, home loan, student loan, and two credit cards. |

| 1990-03-01 | This user has debt totaling $20,000 distributed across an auto loan, home loan, student loan, two credit cards, a personal loan and a miscellaneous liability. |

| 1990-04-10 | This user has debt totaling $25,000, distributed across an auto loan, home loan, student loan, two credit cards, a personal loan, and a miscellaneous liability. |

| 1990-04-12 | This user has debt totaling $30,000, distributed across auto loans, a home loan, student loan, two credit cards, a personal loan, and miscellaneous liabilities. |

Fallback

In a small number of cases, we won't be able to verify a user's identity using only a phone number and date of birth. In those cases, we recommend that you fall back to our Debt Connect module instead.

The best mechanism for this is monitoring based on the module specific events.

DIM API and Callbacks

For a complete overview of the DIM API and callbacks, visit this page.

To learn more about our debt APIs and 1-click solutions, visit spinwheel.io.

Updated over 1 year ago